Governance rigidity, industry evolution, and value capture in platform ecosystems

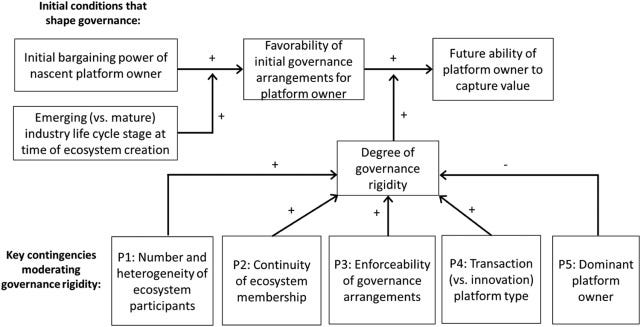

Existing work has shown how, in platform ecosystems, firms can capture above-average rents by controlling hard-to-replace segments. However, initial conditions can have a lasting effect on a platform owner's ability to capture value as the ecosystem in which it operates evolves. We develop a theoretical framework that first considers the role of bargaining power and industry life cycle stage, showing how these shape initial governance arrangements and the platform owner's subsequent ability to capture value based on the rigidity of these arrangements. We then develop propositions, focusing on contingencies that moderate this degree of governance rigidity in platform ecosystems. Our framework helps understand the combined effects of initial conditions and governance rigidity as key drivers of a platform owner's ability to capture rents. Once we consider these dynamics, controlling a hard-to-replace segment may neither be sufficient nor necessary to obtain a large share of the value created by an ecosystem.

See more at: Uzunca, B., Sharapov, D., & Tee, R. (2022). Governance rigidity, industry evolution, and value capture in platform ecosystems. Research Policy, 51(7), 104560. https://doi.org/10.1016/j.respol.2022.104560